For our experienced homebuyers, do you remember what it was like purchasing your first home? Everything seemed so overwhelming but exciting at the same time. You were finally beginning a new chapter in your life and possibly making the largest purchase of your life. We understand that this is no small task for new and seasoned homebuyers. It can take months to get you into your forever home, and those months can be filled with anxiety and impatience. That is why we put together financial tips for homebuyers.

Having the best home buying experience means that you need to be prepared. While you can be prepared for everything, these financial tips for homebuyers will give you a good head start. Buying your first home is a brand-new experience, and for some people, it is one of the only times they will interact with mortgage lenders, realtors, inspectors, sellers etc. Whether you are looking for your forever home or a home for just a few years, we know that these tips will help you along your house-buying journey!

Be Smart With Your Credit

Our first tip is something that every mortgage lender will also tell you, be smart with your credit! The first step to being smart with your credit is making sure all your bills are paid on time. We understand sometimes you get busy and forget about things, but, if necessary, all of your accounts should be autopay to make sure nothing goes unpaid. Payment history makes up about 35% of your credit score. Take a look into your credit before going to a mortgage lender. You can pull your credit report once a year for free from each of the three credit bureaus. This will give you the chance to dispute any misinformation or fraudulent activity on your credit.

One thing that will instantly boost your credit score is paying down credit cards and keeping them under 30% utilization. An example of this is that if your credit card has a $1,000 limit, your running total (the amount reported to credit bureau’s) month to month should not be higher than $300. Follow these tips, and making your credit a priority before buying could save you thousands of dollars.

Identify Your Needs

The next step to buying a home is identifying your needs. The best way to think about this is to write down what you are looking for and separate them into two buckets. One bucket is for things you need, and the other is for what you want. An example of things you need would be a fenced-in backyard for your dog or two bedrooms for your children. An example of a want would be an updated kitchen. Families are always happier in their homes when it meets all their needs and a few of their wants.

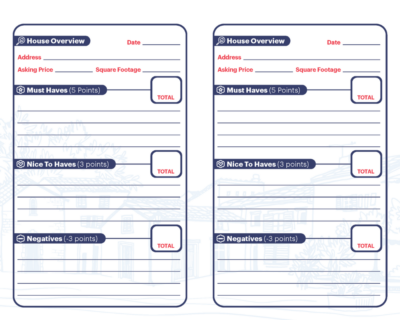

By identifying your needs and wants, you can tour homes and go to open houses with a clear picture of what you are looking for. If you are currently touring homes, download our AHR Scorecard. With this scorecard, you can keep track of your wants and needs. Not only will this help your realtor, but it will give you a sense of direction.

Build Up Your Savings

Having savings seems like a no-brainer for first-time homebuyers, but many people are confused about how much they will need. Buying a house is one of the most expensive purchases you will ever make, and that means that things can get pricey. We are not telling you this to worry you. Instead, we want you to be prepared for some of the extra costs you may not have thought about.

First, your mortgage lender will require at least a 3-20% down payment unless you access other loan types like the VA home loan. Next, you need to think about costs like mortgage insurance, home insurance, closing costs, home repairs and application fees. While a lot of this might be wrapped up in your mortgage, it is crucial you budget accordingly. Using things like this mortgage calculator or talking to your bank can be helpful!

Research Mortgage Loan Options

Next, you want to research mortgage types before looking for a mortgage lender. There are many different mortgage types, and they are all different depending on your situation. For example, you may be able to access an FHA mortgage loan, or if you or your spouse were active military, you might have access to the VA home loan. These are just a couple of the options that you may find while researching. Understanding your options while looking for a mortgage lender will ensure that you are getting a good deal!

Get Preapproved Before Shopping

Getting preapproved before house shopping is one of the essential tips on the list. Make sure you get preapproved before you begin seriously looking for a home. Many people get preapproved and prequalified confused. Prequalified means that you may receive a certain amount from a lender, but you have not undergone the approval process. Preapproval means you are approved for a specific amount by your mortgage lender. In such a competitive market, it is crucial that you are ready to make an offer as soon as possible. This will help your real estate agent and relieve some of your stress.

Get More Information

We hope these financial tips for homebuyers help you along your house hunting journey. The house buying process does not need to be as stressful as everyone makes it seem. Get in contact with an agent you can trust to find you the best deal. If you are interested in purchasing a home or selling a home in East Central Indiana, learn more about American Heritage Realty. We have been in operation since 1977, and we have the expertise and technology to help you buy a home or sell a home. Get to know us!